In early summer of 2021, when we surveyed a variety of companies in the U.S., 70% of business leaders were expecting a return to the office after Labor Day weekend. We now know that was wishful thinking. The delta variant has since delayed many companies’ plans. And yet, the sentiment about the office hasn’t changed. Even though delta changed the timeline, workers around the world still place a great deal of value in the physical workplace — and our newest data from the U.S. shows that people at the top performing companies in particular value the physical workplace and look forward to resuming in-person work.

To understand how expectations and needs around the future of work and the workplace continue to evolve, we surveyed 2,000+ U.S. leaders and knowledge workers across 10 industries in May/June 2021 to capture current sentiment around the workplace as offices begin to reopen. The survey findings offer valuable insights into what companies were planning at that time, and the continued importance of the office as a place for a range of activities. (In this study, we define top-performing companies as organizations that have recently been ranked on a Most Admired, Best Places to Work, and Most Innovative Companies list.)

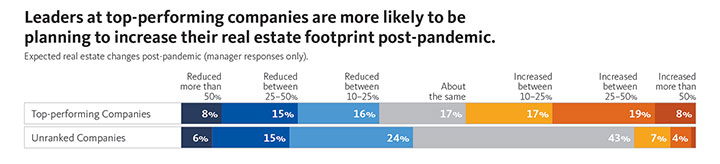

According to our U.S. Workplace Survey 2021 research, leaders at top-performing companies knew early in the pandemic that the office held value — not just for collaboration, but for many types of work-related activities. That’s why leaders at these companies are investing in more space for the office. In fact, top-performing companies are 3x more likely to increase their real estate footprint in the future because of the need to accommodate more people and more kinds of spaces for a range of work activities.

Since we began thinking about hybrid work and the future of the office, the popular perception was that the office was for collaboration and social-cultural activities, but not good for focus — despite the fact that some research, including our own, found that many people already saw the office as a better place for focus work than their homes. Our recent research now underscores that people at top-performing companies see the office as a place for social interaction, as well as for other activities, including mentorship, deep concentration, and focus work.

From our 2020 U.S. Workplace Survey, based on data collected in late 2019, we know that many top-performing companies were already working in a hybrid model before the pandemic — meaning they already recognized the need to adapt the office for changing workstyles. These companies continue to purchase more Class A office space, focusing less on condensing their footprint and more on the quality of the space and the variety of experiences for their people.

Here’s what leaders at top-performing companies who we surveyed said about how their real estate might change post-pandemic:

Top-performing companies are planning to increase their real estate footprint.

Despite employees’ continued preference for flexibility and the ability to work remotely, the workplace remains the preferred location for the majority of work activities, and leaders at top-performing companies are more likely to be planning to increase their real estate footprint post-pandemic. Approximately 44% of top-performing companies expect to increase real estate needs post-COVID, vs. just 11% of unranked companies.

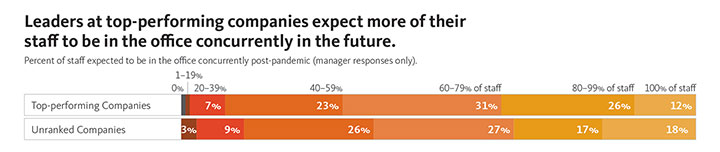

Leaders at top-performing companies expect more of their staff to be in the office concurrently.

In the future, leaders expect the majority of staff will still be in the office — with a focus on collaboration, ideation, and problem solving.

Exactly how, and when, a broader transition back to the workplace will occur is of course still in flux as the world continues to reckon with the changing landscape of the coronavirus and the delta variant. One place where employees at top-performing companies do not differ in their perspectives — they do continue to prioritize a hybrid work future, with the ability to continue working remotely; and their companies do continue to focus on providing flexibility and choice as part of that return. But as they look to the future, it’s clear that top-performers see their workers choosing to be in the office and work in-person for a significant portion of their work weeks.

Download the full U.S. Workplace Survey, Summer 2021 to explore more insights.

Editor’s note: this article originally appeared on gensler.com